10 Different ways to use the envelope system and make it work for you!

Although people have been using some form of the “envelope system” for generations, it was really, Dave Ramsey who popularized it as a way to get out of debt.

I’m a big fan of Dave Ramsey. The idea that you can take control of your money, and give every dollar a purpose, really resonated with me. I like the idea that we don’t just spend money mindlessly. That’s the quickest way to go broke, no matter what your earning potential is. But if you decide to use the envelope system to get out of debt, that’s when you can REALLY see results.

As I’ve tried to incorporate the Envelope system into our life however, I found I really had to personalize it to make it work for my lifestyle. I just couldn’t carry actual envelopes into the grocery store. My purse was already full enough, and sometimes, when my envelopes would run out of money, I would just use a debit card! That wasn’t good. I found some of these other methods can really help if you want to make it work for you.

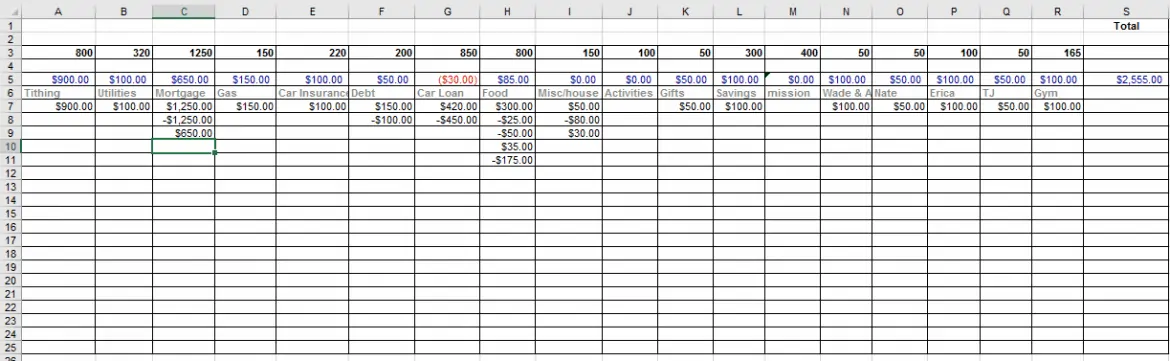

1 – Excel Spreadsheet Tracking.

The method I’ve personally been using for almost 14 years is an excel spreadsheet that auto calculates my balance in each spending category or “envelope”. This works for us! Every time we are paid, I “deposit” the proper amount of money into each column. As I spend, I subtract that amount from the spending category.

What I have left in that category is displayed at the top, and the far right hand column is the balance that matches the balance in my checking account! It’s so brilliant and so usable for me, that I’ve been using it for 14 years, and I’ll likely never give it up.

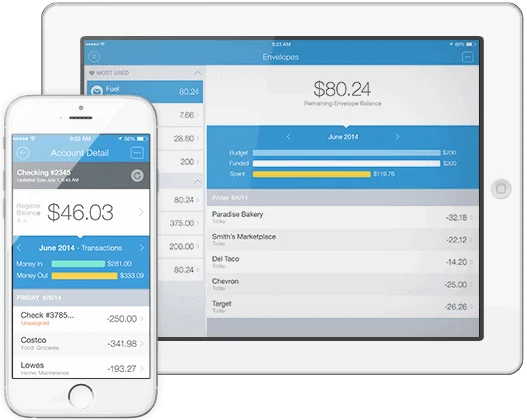

2 – Apps

There is an app that mimics actual envelopes called Mvelopes! Apps like this are nice, because if they sync with your bank, the categories you are spending in sort themselves out.

You can run reports to REALLY see how much you are spending on groceries each month, and you can keep track on your phone, without the need to carry cash with you for all your spending.

3- Pretty Envelopes

I love these polka dot printable envelopes because it also includes a tracking sheet on the front of the envelope! That way, when you fill in every line, you can just print another.

I like the different color polka dots as well, to help you remember which category each envelope represents.

4- Binder Clips

I actually like this low maintenance, no-fuss method, just use some binder clips. I’ve done this before and will usually include a scrappy piece of paper or a post it note just to write down what the spending category is, or notes to myself about what I’m using that cash for.

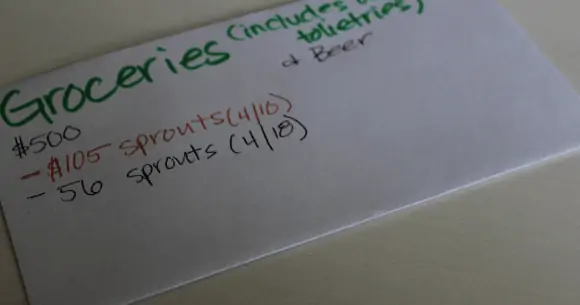

5- The cashless envelopes

This is almost so obvious, that it’s not! For real. What a great idea. This blogger uses actual envelopes, but doesn’t literally put the cash inside. Instead, she uses the envelopes as her tracking system, subtracting spent money, and “depositing” new money.

6- The Artisan Solution- Wallets on Etsy!

These are ADORABLE!! I actually might start carrying cash again if I had one of these hand crafted beauties! Check out these amazing cash envelope wallets on Etsy.

Or this one with simple dividers. But that’s not all! You can find these beauties just about anywhere.

7- The Accordion pocket book

Basic, accordion style organizers, generally used for coupons also work great for money sorting. The tabs at the top are essential for keeping your money separated by category. This is a very inexpensive solution, and will allow you to carry only the cash that you would use on discretionary spending outside the house.

8- The Binder Style Envelope

Take one small binder, plus envelopes with small ring holes, and you have the binder style envelopes! You technically could make this yourself, but I found this amazing option:

9- Planner Inserts

Back in the day when I was addicted to my Franklin Planner, I loved the expense envelope inserts Expense Envelopes that you could buy to carry with you in your planner ALL. THE. TIME!

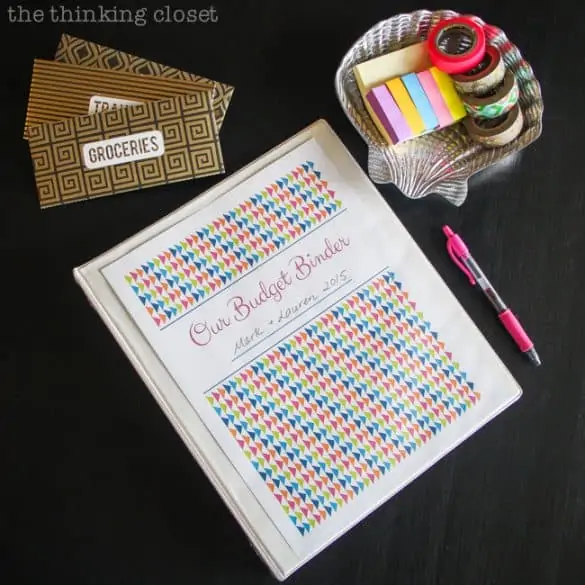

10- The Full Monte Binder System!

The feeling of being completely organized and having all your financial world in one binder, makes my organizing heart sing! This blogger was able to get that system down to one binder.

Get organized and take control of your budget today by implementing a version of the envelope system that will work for you!