Setting up a budget that your entire family is familiar with is very important. Having a visual for both the adults and children in the family to physically look at helps everyone understand where money is coming from and where it is going each month. While you don’t necessarily have to show the kids all of the family’s financial details, it is a good idea to make them aware of the importance of money and how to balance a budget. These are all skills they can utilize in their own lives when they get older.

Set Up the Skeleton

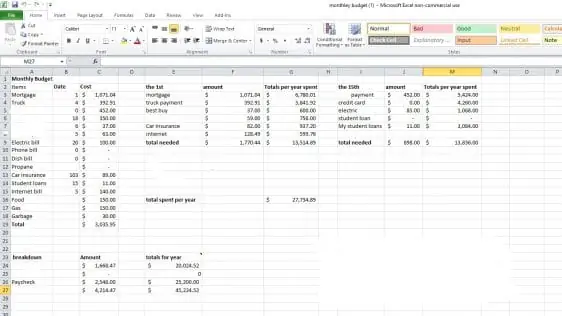

Use a program such as Microsoft Excel to create a spreadsheet where you can create an itemized table/chart. On the left side of the spreadsheet create a list of all of your family’s expenses. This will include your mortgage/rent, bills, and any additional expenses. If you plan to show this to your children, it might be a good idea to include their costs as well. Example, the cost of their phone bill or any membership or club fees they are in.

Along the top rows list the total cost of each of your expenses and total them all up at the bottom. Using the addition panels to the right, break down what expenses come out at what time of the moth. For example, if your mortgage, car payment and internet come out on the 1st of the month then include those. Do the same thing for each additional batch of bills that come out during different times of the month. On the bottom of the spreadsheet, include the incoming sources of income. This way you will have a firm account on the amount of incoming coming in and going out. (Refer to spreadsheet for example).

Hold a Pow Wow

After you have the spreadsheet in relatively good form, call the family in to review everything that you imputed. Show them where the income is coming in from all sources. Being open and honest with your children about how much the family brings in helps them realize exactly what money is actually available each month. This will come in handy the next time they ask for an expensive new cell phone or video game!

Make sure that you included the fees their expenses bring to the family in/out budget. Be sure to note the totals on the spreadsheet for each expense – the mortgage, the groceries, and any recreational fees should be of particular importance to teenage children. They might be surprised by how much of the budget goes to these items! After you’ve gone over the family budget, perhaps you can discuss strategies to cut costs in certain places or add additional income.

Getting children familiar with brainstorming ways to contribute at an early age really gets them thinking about what they can do to help out. Now, you don’t have to make them feel obligated to go out and get a part-time job but instilling the ethics of financial savviness from a young age never hurt anyone!

Budget Related Bonding

There are activities that you can do to give your children a sense of the power of the dollar. Speak with your employer to see if your child can accompany you to work one day. This would give them a hands-on view of what exactly it is you do all day to bring home the paycheck that feeds them, clothes them, and puts a roof over their head.

Consider scheduling a meeting with a financial advisor. Bring the family so everyone can hear the planner’s tips as to how the money can be spent or saved. Encourage your children to ask questions and to speak up if they have an idea as well. Finally, consider setting up a trip to your local bank or credit union to set up a savings or checking account for your child in their name. This could be a great way for them to see where any birthday money or money earned doing chores or odd jobs can be put and accumulated over time.

Savings accounts work particularly well for this. Your child can see the account grow from the time they are young to the time they reach 18. It will truly make them appreciate how far a little hard work and financial know-how can get them. And maybe, they might even get something great out of it – like a first car?